Selling A home in Randallstown, MD

We've all had that experience: the pushy salesperson who doesn't listen, the professional more interested in their paycheck than your problem. Imagine that feeling during the biggest financial decision of your life. For many, that's the anxiety of hiring a real estate agent, but it doesn't have to be that way.

This common fear highlights the crucial difference between a transactional vs. a relational realtor. One sees a single commission check, focusing on closing the deal as quickly as possible. The other sees a lifelong client, focusing on your well-being and earning your trust for years to come.

This client-first philosophy is the core of a quality service mindset. It transforms an agent from a simple salesperson into a dedicated guide whose priority is your success and peace of mind. By understanding what this looks like, you can find a professional who truly puts you first.

The Transactional Trap: Why "Just Closing the Deal" Is a Red Flag

When you're making the biggest purchase of your life, the last thing you want is an agent whose primary focus is simply getting the deal to the closing table. Their world revolves around contracts, deadlines, and commission checks.

You can often spot this approach through their actions. They might pressure you to make a quick offer, downplay concerns you raise about an inspection report, or disappear the moment the papers are signed. While speed can seem efficient, this mindset often prioritizes the agent's timeline over your long-term financial safety and peace of mind. The goal becomes the transaction itself, not your success within it.

In stark contrast is the relational agent, who operates more like a trusted consultant. They understand that their reputation is their most valuable asset, and it's built by earning your trust for life. A relational agent would rather see you walk away from a bad deal than close it, because they know their job is to protect your best interests above all else. This better, relationship-based approach starts with one powerful, yet often overlooked, skill.

The First Pillar of Great Service: Shifting from Talking to Deep Listening

That foundational skill is not salesmanship; it's a profound form of listening. While a transactional agent hears your checklist---"three beds, two baths, good school district"---a relational agent listens for the life behind that list. They don't just hear what you want; they seek to understand why you want it. This shift from hearing requests to diagnosing needs is the first, most critical pillar of exceptional service.

Imagine you tell an agent, "We need a big backyard." An average agent simply adds "large lot" to their search filter. But an agent practicing deep listening will ask a follow-up question: "That's important. What do you envision happening in that big backyard?" Your answer might reveal everything. Are you dreaming of a garden, a safe place for a toddler to play, or a patio for entertaining friends? Each of these implies a very different type of yard.

By asking "why," the agent moves beyond the surface-level feature and uncovers your core motivation. This prevents you from wasting weekends touring homes that technically match your criteria but completely miss the point of what you truly need. Instead of showing you ten houses with big, empty lots, they can pinpoint two homes with perfect, fenced-in play areas or an ideal spot for a future deck.

This level of listening does more than save time; it builds a foundation of trust. It proves the agent is invested in your outcome, not just their commission.

The Second Pillar: How Proactive Education Cures Client Anxiety

Once an agent truly understands your goals, their next job is to light the path ahead. The home-buying process is often filled with confusing steps and long periods of silence that create enormous stress. A great agent practices proactive education, providing answers before you even know what to ask.

This proactive approach is a system built on experience. The best agents have walked through the process hundreds of times, allowing them to anticipate your concerns. They map the client journey to identify potential points of confusion, actively managing your experience rather than just reacting to the transaction.

Instead of leaving you in the dark after your offer is accepted, they might send a simple "What's Next" email that turns uncertainty into a manageable checklist. It could look something like this:

This simple act of communication changes everything. It doesn't just give you information; it gives you a sense of control and confidence. Knowing what's coming next replaces fear with anticipation.

The Third Pillar: Transforming from Problem-Spotter to Expert Problem-Solver

No amount of planning can prevent every hiccup. In any real estate transaction, the unexpected is almost guaranteed. It's in these moments that an agent's true value is revealed. Do they simply report bad news, or do they guide you toward a solution?

An average agent might call you and say, "We have a problem. The inspection report shows the furnace is failing. What do you want to do?" That question immediately transfers the entire weight of the problem onto your shoulders. In contrast, a service-minded agent calls with a different approach: "I have an update on the inspection. It looks like the furnace is near the end of its life. I've already contacted a trusted HVAC specialist to get a rough estimate for a replacement, and I have a few strategies for how we can negotiate this with the seller. Do you have a few minutes to discuss the best option for you?"

This subtle shift in communication makes all the difference. The first approach creates anxiety; the second delivers confidence. By presenting solutions instead of just problems, the agent demonstrates that they are not just a participant in your transaction but your dedicated advocate. This proactive problem-solving is the single fastest way an agent can build unshakable trust.

The Foundation of It All: What "Fiduciary Duty" Looks like in the Real World

This professional obligation has a name: fiduciary duty. While it may sound like complex legal jargon, it's a simple and powerful promise. It means an agent is legally and ethically bound to act in your absolute best interest, putting your financial well-being above their own paycheck. Think of it like the duty a doctor has to be a patient---your welfare is the only priority.

In practice, this commitment leads to what you might call radical transparency. Imagine you fall in love with a house, but your agent, after doing their research, advises you not to buy it. They might point out that a new highway is planned nearby, which could hurt the home's resale value in five years. By giving you this advice, they are actively risking their commission for your long-term benefit. This is the opposite of a pushy salesperson; it's the mark of a true advisor.

When an agent demonstrates they value your future over their immediate income, it builds a foundation of unshakable trust. You stop worrying if you're being "sold" and start feeling like you have a genuine expert on your side.

Three Simple Signs You've Found an Agent Who Will Put You First

As you interview potential agents, use these signs to distinguish a transactional salesperson from a relational guide dedicated to your well-being. A service-minded professional will reveal themselves because:

Ultimately, your goal is not just to buy or sell a house, but to do so with confidence. Choosing an agent is the first major decision in your transaction, and it sets the tone for the entire experience. By demanding this higher standard of service, you ensure your success is measured by your own peace of mind, not just a set of keys. At Associated Real Estate-Ted Coates your goal is our goal.

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

Free Home Valuation | Baltimore Metro Home Value Report

Unlock Your Free Home Value Report

Know what your home is really worth in today’s Baltimore Metro market.

Get a free, no-obligation home valuation backed by local market data and expert insight from Associated Real Estate – Ted Coates, trusted Baltimore Metro real estate professionals since 1973.

Get My Free Home Valuation - https://sellbuybaltimore.com/home-valuation

Accurate. Confidential. No pressure.

________________________________________

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

If you’ve seen headlines saying foreclosure activity has been climbing for 10 straight months, it’s easy to assume that's a sign of trouble for the housing market. But when you look at the full picture, a few simple truths become clear:

Foreclosure Filings Are Up 32%, But That Doesn’t Mean the Market’s in Trouble

If you peel the layers all the way back, what everyone is actually worried about is that we’re headed for a repeat of what happened in 2008. Back then, riskier lending practices and an oversupply of homes for sale brought home prices down and led to a significant increase in foreclosures. A lot of people felt the impact. But this isn’t the same situation.

Yes, ATTOM data shows foreclosure filings are up 32% year-over-year. And that increase is going to sound dramatic. But context matters, and it doesn’t mean we’re headed for another crash. And the numbers prove it. Take a look at where we were during the last crash (the red in the graph below). And where we are now (the blue):

Even with the uptick lately, we are still nowhere near crash levels – far from it. This isn’t a return to crisis levels. What it is, is a return to normal.

The graph below shows foreclosure filings going all the way back to early 2005. The lead up to, and the aftermath of, the crash is there in red. Those are the years when foreclosure filings went above the 1 million mark each year.

Now, look at the right side and scan back to the 2017–2019 range (the last truly normal years for housing). You’ll see we’re actually just starting to fall back in line with what’s typical for the market, even with the increase lately:

Rob Barber, CEO at ATTOM, explains it well:

“Foreclosure activity increased in 2025, reflecting a continued normalization of the housing market following several years of historically low levels . . . While filings, starts, and repossessions all rose compared to 2024, foreclosure activity remains well below pre-pandemic norms and a fraction of what we saw during the last housing crisis . . . today’s uptick is being driven more by market recalibration than widespread homeowner distress, with strong equity positions and more disciplined lending continuing to limit risk.”

The word “normalization” in that quote is extra important. While economic and financial pressures are putting a strain on some homeowners, this isn’t a flood of distressed homes. No matter what the headlines may have you believe, this isn’t a large-scale crisis.

Today’s increase isn’t a sign of trouble. It’s a return to normal.

Why This Isn't a Repeat of 2008

Even though the last housing crash still shapes how a lot of people interpret today’s news, the reality is, this is a different market:

And that equity piece is especially important. Over the last five years, home prices have risen significantly. For many people, their house is worth far more than they paid for it. That means most homeowners have a strong financial cushion to fall back on, if needed.

Basically, if someone faces hardship today, they often have the option to sell, and maybe even walk away with money in their pocket, instead of going through foreclosure. That’s a major contrast to 2008, when many homeowners owed more than their home was worth.

Foreclosure activity may be rising, but it’s still well within a normal range – and nowhere close to the danger zones of the past. But the headlines are doing more to terrify than clarify. And that’s exactly why having a trusted real estate expert you can call on is so important.

When you hear something in the news or see something on social about housing that worries you, please reach out so you have the context to understand what’s really happening and how it impacts you (if at all).

https://sellbuybaltimore.com Associated Real estate- Ted Coates

6 Jan 2026 20:37

2 Jan 2026 16:28

What Every Maryland Homeowner Should Know

24 Aug 2025 12:12

12 Jul 2025 14:08

Thinking about protecting your home with a trust but still paying off your mortgage? You’re not alone. In this video, I’ll break down everything you need to know about putting your house in a trust—even if you still owe money on it.

Planning to sell this spring? While you may be tempted to hold off until the first blooms or the spring showers hit, that's actually waiting too long to get started by today’s standards.

Buyers have more options than they did a few years ago. So, it's worth it to tackle repairs now and make sure your house is set up to stand out. Because you don’t want to be caught scrambling right before the spring rush. Or, running out of time to do the work your house really needs.

The key is focusing on updates that actually matter. And that’s exactly where return-on-investment (ROI) data comes in handy.

Which Projects Tend to Pay Off?

Every year, Zonda looks at which home improvements deliver the most bang for the buck when you go to sell the home. And the results can be a little surprising.

The green in the chart below shows the updates where sellers have the biggest potential to add value based on that research:

While there's a wide range of projects represented in this data, the cool part is, some of the top winners aren’t big to-dos. They’re just swapping outdoors.

Small Updates, Big Visual Impact

This goes to show little projects can have a big impact. So, you don’t have to spend a fortune. And you don’t need to tackle everything on this list. But in today’s market, doing nothing can work against you.

Now that buyers have more homes to choose from, a lot of them are going to opt for what’s move-in ready.

The best advice? Focus on what your house needs, whether it’s listed here or not – like the repairs you’ve been putting off. A front door or shutters in need of a little TLC. Piles of leaves in the yard. Scuffed up paint where your kids play inside. Those details matter too.

Mallory Slesser, Interior designer and Home Stager, explains it to the National Association of Realtors (NAR) this way:

“If you’re looking for affordable updates that pack a punch, dollar for dollar, I would say painting; changing out light fixtures; changing out hardware; maybe new draperies or window treatments. Those are all cost-effective ways to make a big statement. It really changes the space.”

These seemingly small things help buyers focus on the home itself – not the work they think they’ll have to do after moving in. And that’s paying off for other sellers. Buyers are often willing to spend more on homes that feel well cared for, updated, and move-in ready.

This Chart Is a Starting Point, not a Strategy

Here’s the important thing to remember. National data like this is a guideline. Buyer preferences are going to vary by location, price point, and even neighborhood. That means a project that boosts value in one area might be unnecessary (or even overkill) in yours.

That’s why the first step should always be to talk with a local real estate professional before you start.

An experienced agent can help you answer questions like:

That guidance helps you avoid over-improving and under-preparing.

If you’re looking to sell this spring, you still have time to make updates that help your home stand out – without taking on a full renovation.

If you’re not sure where to start, let’s talk through what makes sense for your house. A quick conversation can help you prioritize the updates that’ll pack the biggest punch.

What’s one upgrade you’ve been thinking about – and wondering if it’s worth it?

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

Don’t rely on national housing market headlines to understand your local market; that’s the key takeaway from Realtor.com®’s December monthly housing report, which reveals how dramatically individual metros diverged from broader trends throughout 2025.

Local Housing Story vs. National Trends

Why Catonsville, Randallstown & Owings Mills Don’t Always Follow the Headlines

When you hear housing news on TV or online, it’s usually based on national averages. But real estate doesn’t move nationally, locally, street by street and neighborhood by neighborhood.

That’s especially true in Catonsville, Randallstown, and Owings Mills, where market behavior often looks very different from what national reports suggest.

What National Headlines Often Miss

National housing trends tend to reflect:

Those conditions don’t always apply to established Baltimore County communities with:

As a result, national stories about “prices dropping” or “buyers disappearing” may not reflect what’s actually happening locally.

How the Local Market Really Behaves

In Catonsville

In Randallstown

In Owings Mills

Across all three areas, the market tends to be selective—not stalled.

The Key Difference: Local Strategy Beats National Timing

Homeowners who rely only on national data often ask:

“Should I wait until the market improves?”

Local data asks a better question:

“How is my neighborhood performing right now?”

In many Baltimore County neighborhoods:

What This Means for You as a Homeowner

If you own a home in Catonsville, Randallstown, or Owings Mills:

Local Knowledge Matters More Than Ever

At Associated Real Estate, we focus on what’s happening in your neighborhood, not just what’s trending nationally. That local perspective helps homeowners make confident, informed decisions—whether they’re selling now or simply planning.

Thinking about selling or just want clarity?

A local market conversation can give you far more insight than any national headline ever could.

👉 Understanding your home’s current value

Free Maryland Home Valuation | Associated Real Estate

📘 Download Your FREE Smart Seller’s Guide

📞 Book Your Complimentary 15-Minute Strategy Call

Associated Real Estate- Ted Coates

🌐 www.sellbuybaltimore.com

☎️ 410-340-4155 | ✉️ tcoates859@yahoo.com

6 Jan 2026 20:37

2 Jan 2026 16:28

What Every Maryland Homeowner Should Know

24 Aug 2025 12:12

12 Jul 2025 14:08

Thinking about protecting your home with a trust but still paying off your mortgage? You’re not alone. In this video, I’ll break down everything you need to know about putting your house in a trust—even if you still owe money on it.

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

Your choice should match your intention for (1) control while you own the property, (2) what happens at sale, and (3) what happens at death. Maryland recognizes several common ways to hold title.

1) Sole ownership (one person or one entity)

Who uses it: An individual, or a legal entity (LLC, corporation, or trust).

At death: Passes according to your will or Maryland intestacy (i.e., it goes through probate unless you’ve planned otherwise).

Notes: You can deed a home into a revocable living trust to avoid probate; that requires a new deed to the trust.

Maryland People's Law Library

2) Tenants by the Entirety (TBE) — married couples only

Who uses it: Legally married spouses (same-sex marriages included).

Survivorship: Yes. If one spouse dies, the survivor owns the whole property automatically.

Creditor protection: Strong protection from one spouse’s separate creditors (exceptions include federal tax liens and joint debts).

Presumptions: In Maryland, a deed to a married couple is presumed to create TBE unless it says otherwise; divorce converts TBE into tenants in common.

Maryland People's Law Library

Why choose it: Survivorship + asset-protection benefits for married couples.

Franke Beckett LLC

3) Joint Tenancy with Right of Survivorship (JTWROS)

Who uses it: Any two or more people (spouses, partners, family, friends).

Survivorship: Yes—shares pass to surviving co-owners outside probate.

Maryland drafting rule: The deed must clearly state joint tenancy with survivorship; otherwise, Maryland presumes a different form (see “Tenants in Common” below).

Maryland People's Law Library

Why choose it: Simple probate-avoidance between co-owners who want the survivor(s) to get 100%.

4) Tenants in Common (TIC)

Who uses it: Any two or more people or entities.

Shares: Can be equal or unequal (e.g., 75%/25%). Everyone still has the right to use the whole property.

Survivorship: No. Each owner’s share passes by will or intestacy and may go through probate.

Maryland default: If a deed to multiple owners doesn’t clearly create JTWROS or TBE, it’s presumed to be TIC.

Maryland People's Law Library

Why choose it: Flexibility (different ownership percentages; estate-plan control for each owner’s share).

5) Life estate deeds (including “enhanced” / “Lady Bird” style)

Standard life estate: The “life tenant” keeps the right to use the property for life; the “remainderman” automatically takes full ownership at the life tenant’s death (avoids probate for that property).

Maryland People's Law Library

Enhanced life estate (often called “Lady Bird”): A life estate with powers—the life tenant keeps the right to sell, mortgage, or change beneficiaries during life. Maryland practitioners use life-estate deeds with powers to similar effect. Suitability is highly fact specific.

Stouffer Legal

Jeff Rogyom, Attorney at Law

6) Title in a trust or business entity

Revocable living trust: You (as trustee) hold title for your benefit; upon death, a successor trustee transfers or manages the property without probate. Requires deeding the property into the trust.

Maryland People's Law Library

LLC or corporation: Common for rentals/investments to separate liability and clarify ownership among investors. (Ask counsel about transfer/recordation taxes, due-on-sale, insurance, and financing implications.)

Quick Comparison

Probate-avoidance: TBE ✅ • JTWROS ✅ • Life estate ✅ • Trust ✅ • TIC ❌ (unless separately planned).

Maryland People's Law Library

+2

Maryland People's Law Library

+2

Creditor protection (one spouse’s separate debts): Strongest with TBE (not absolute—federal tax liens and joint debts can reach it). JTWROS/TIC don’t offer the same protection.

Franke Beckett LLC

Flexibility to leave your share to someone else: TIC ✅ • JTWROS ❌ (survivorship controls) • TBE ❌ (survivorship controls) • Trust ✅ • Life estate varies by deed terms.

Maryland People's Law Library

Maryland-specific notes to know

Clear deed language matters. Maryland presumes TIC unless the deed expressly creates JTWROS, and it presumes TBE when a deed is to a married couple.

Maryland People's Law Library

Divorce changes TBE. A TBE becomes a TIC upon divorce unless retitled.

Maryland People's Law Library

Transfer-on-Death (TOD) deeds: Not recognized in Maryland as of August 2025 (though legislation has been proposed). Plan with trusts, life-estate deeds, or survivorship instead.

Maryland People's Law Library

RKW Law Group

How to choose (rule-of-thumb—not legal advice)

Married couple who wants survivorship + creditor protection: Consider TBE.

Franke Beckett LLC

Partners/family who want the survivor to get 100%: Consider JTWROS with clear deed wording.

Maryland People's Law Library

Co-owners who want control over who inherits their share (children, trusts, etc.): Consider TIC with a written co-owner agreement.

Maryland People's Law Library

Estate-planning to avoid probate while keeping control: Consider a revocable living trust or an enhanced life-estate deed (case-by-case).

Maryland People's Law Library

+1

Investors/landlords: Consider LLC ownership for liability separation; coordinate with lender, insurer, and CPA.

Practical drafting tips

Put the exact vesting language you intend in the deed (e.g., “as joint tenants with right of survivorship” or “as tenants by the entirety”). Without that clarity, Maryland law may default you into a different form than you expect.

Maryland People's Law Library

Confirm names/marital status and how you want the property to pass at death before closing documents are prepared.

Revisit title if your life changes (marriage, divorce, new beneficiaries, new entity/trust).

Important disclaimer & next step

This is general information about Maryland law, not legal advice for your situation. For personalized guidance—especially on taxes, creditor issues,

Medicaid, or blended-family planning—consult a Maryland real estate/estate-planning attorney.

6 Jan 2026 20:37

2 Jan 2026 16:28

What Every Maryland Homeowner Should Know

24 Aug 2025 12:12

12 Jul 2025 14:08

Thinking about protecting your home with a trust but still paying off your mortgage? You’re not alone. In this video, I’ll break down everything you need to know about putting your house in a trust—even if you still owe money on it.

6 Jan 2026 20:37

2 Jan 2026 16:28

What Every Maryland Homeowner Should Know

24 Aug 2025 12:12

12 Jul 2025 14:08

Thinking about protecting your home with a trust but still paying off your mortgage? You’re not alone. In this video, I’ll break down everything you need to know about putting your house in a trust—even if you still owe money on it.

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

Getting to Know the Baltimore Metro Area

Where Urban Charm Meets Suburban Comfort

The Baltimore Metro Area blends historic character, modern convenience, and a diversity of communities to suit every lifestyle. From walkable waterfront neighborhoods to tree-lined suburbs, this region offers access to world-class medical institutions like Johns Hopkins, a thriving arts and food scene, and proximity to major job centers like Washington, D.C., Philadelphia, and New York. Whether you're searching for culture, career opportunities, or a peaceful retreat, Baltimore delivers exceptional value and variety in the Mid-Atlantic housing market.

📍 BALTIMORE COUNTY

A Mix of Historic Charm, Suburban Ease, and Waterfront Living

🏡 Suburban & Family-Friendly

🌲 Scenic & Upscale

🌊 Waterfront & Outdoor Living

🚉 Transit-Accessible & Growing

🌿 Rural & Retreat-Like

🏙️ BALTIMORE CITY

250+ Neighborhoods. Infinite Personality.

🏛️ Historic & Cultural Hubs

🎨 Arts & Entertainment

🌿 Residential & Green Spaces

🌊 Waterfront Living

🏘️ Up-and-Coming & Community-Focused

🌳 HOWARD COUNTY

Planned, Polished, and Full of Green Space

🌆 Columbia – A City of Villages

🏡 Ellicott City – Historic Meets Suburban

👨👩👧👦 Family-Friendly & Active

🚶 Mixed-Use & Walkable

🏡 CARROLL COUNTY

Rural Beauty with Small-Town Warmth

🧡 Small-Town & Community-Oriented

🌄 Scenic & Spacious

🎨 Historic & Artsy

🌿 Rural Retreats

🌊 HARFORD COUNTY

Nature, Community, and Waterfront Bliss

🏘️ Suburban & Family-Friendly

🌳 Rural & Scenic

🌊 Waterfront & Laid-Back

💲 Affordable & Accessible

💎 Upscale & Exclusive

🛥️ ANNE ARUNDEL COUNTY

Historic Shorelines and Family-Friendly Suburbs

🌊 Nautical & Historic

🏡 Suburban & Convenient

🛍️ Accessible & Urban-Suburban

🌇 MONTGOMERY COUNTY

Polished, Prestigious, and Packed with Amenities

🌆 Urban & Walkable

👨👩👧👦 Suburban & Family-Friendly

🌿 Quiet & Residential

💼 Upscale & Exclusive

💼 Let’s Find the Right Fit for You

Whether you're seeking waterfront views, commuter-friendly locations, or quiet charm, there’s a perfect match for your lifestyle across the Baltimore Metro Area and beyond.

🔑 I’m the key to helping you find your perfect home.

Start your search today — there’s something here for everyone.

👉 Start searching now: https://homeasap.com/800380/

12 Feb 2026 11:08

10 Jan 2026 09:55

15 Nov 2025 16:52

Associated Real Estate Unveils a Modern, Smarter Real Estate Experience for Baltimore Homeowners

1 Nov 2025 11:59

Our Value to You — Why Sellers Choose Associated Real Estate-Ted Coates

21 Sept 2025 11:23

Patience Won’t Sell Your House. Pricing Will.

16 Sept 2025 04:36

Closing costs are like the forgotten stepchild in the real estate transaction. Buyers concentrate on the down payment and the purchase price while sellers envision that check they’ll receive at the closing table.

27 Aug 2025 13:45

23 Aug 2025 15:12

Historic Charm • Competitive Offers • Seamless Closings

23 Aug 2025 14:48

With over 50 years of trusted local expertise, we help Baltimore Metro homeowners sell for top dollars without the headaches. Our proven approach delivers results every time.

18 Aug 2025 13:22

14 Jul 2025 14:39

13 Jul 2025 13:57

Home Prices, Forecasts

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

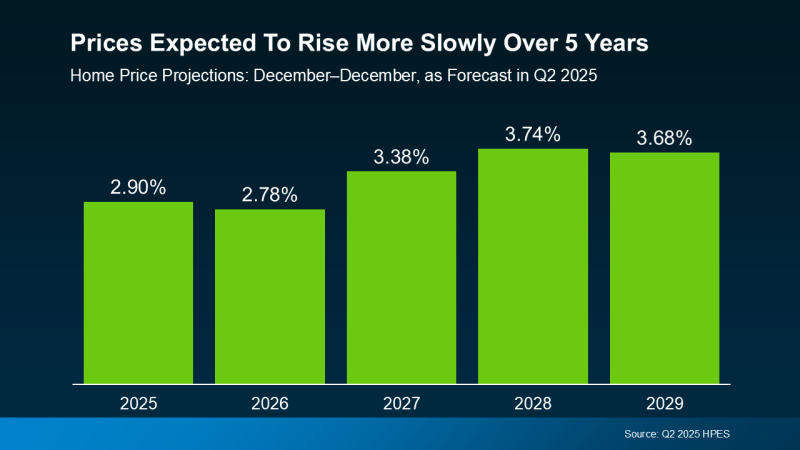

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

a graph with green bars and if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

The average projection is about 3.3% price growth per year, through 2029.

The optimists see growth closer to 5.0% per year.

The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate it faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

Bottom Line

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

6 Jan 2026 20:37

2 Jan 2026 16:28

What Every Maryland Homeowner Should Know

24 Aug 2025 12:12

12 Jul 2025 14:08

Thinking about protecting your home with a trust but still paying off your mortgage? You’re not alone. In this video, I’ll break down everything you need to know about putting your house in a trust—even if you still owe money on it.

2 Jul 2025 22:23

27 Jun 2025 14:12

26 Jun 2025 18:24

Click here to add text.

26 Jun 2025 14:02

26 Jun 2025 07:02

25 Jun 2025 19:58

Federal Housing Finance Agency (FHFA) Director Bill Pulte announced on X (formerly Twitter) this afternoon that the GSEs—mortgage giants Fannie Mae and Freddie Mac—will soon begin considering cryptocurrency as an asset for single-family loans.

24 Jun 2025 14:37

Selling Smart: What Every Homeowner Needs to Know Before Listing Their Property

22 Jun 2025 11:38

Once your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more. That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip this step. An inspection is your chance to avoid costly headaches and get peace of mind. Let’s connect to talk about other ways to make your offer stand out.

22 Jun 2025 11:21

21 Jun 2025 08:54

Real Estate Done Right. Results That Respect Your Time, Money, and Legacy.

21 Jun 2025 08:53

21 Jun 2025 07:05

Are You Thinking About Selling Your House Soon? | Real Estate with Ted TED COATES